We do business in accordance with the Federal Fair Housing Law and the Equal Opportunity Act, and the California Fair Employment and Housing Act.

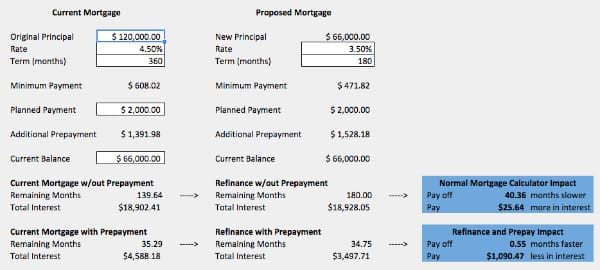

You may contact one directly, or call Greater Nevada Mortgage at (775) 888-6999 or (800) 526-6999. Please contact a mortgage consultant to learn about all details on loan options and programs available. This is not a credit decision or a commitment to lend. Membership with Greater Nevada Credit Union is required for select loan options. Borrower is responsible for any property taxes as a condition of the loan. When you need money that you dont intend to pay back in a short amount of time, refinancing a home is a better option than getting a home equity line of credit. Not all loan options are available in every state. How much house can I afford How much should you put down How much interest will you pay over the life of the loan Mortgage tax deduction calculator Mortgage points calculator Loan. Actual fees, costs and monthly payment on your specific loan transaction may vary, and may include city, county or other additional fees and costs. The estimated total closing costs in these rate scenarios are not a substitute for a Loan Estimate, which includes an estimate of closing costs, which you will receive once you apply for a loan. Your loan’s interest rate will depend upon the specific characteristics of your loan transaction and your credit history up to the time of closing. If mortgage insurance is required, the mortgage insurance premium could increase the APR and the monthly mortgage payment. Depending on loan guidelines, mortgage insurance may be required. When applying for a conventional refinance mortgage, you can refinance up to 80 of your homes value. This loan type is the most common and the most straightforward. There are three possible loan types from which you can choose. Interest rates and APRs are based on current market rates, and may be subject to pricing add-ons related to property type, loan amount, loan-to-value, credit score and other variables. Select the type of loan for which you would like to see the refinance rates. For instance, a 5/1 ARM means that you will pay a fixed rate for the first five years of the loan, and then your rate is subject to change once each year thereafter through the remainder of the loan. Adjustable Rate Mortgage (ARM) loans are subject to interest rate, APR, and payment increase after each change period. Rates are for illustrative purposes only, and assumes a borrower with a credit score of 700 or higher which may be higher or lower than your individual credit score. Enter the specifics about your current mortgage, along with your current appraised value, new loan term, rate and closing costs.

Rates and terms are subject to change without notice.

#Simple refinance mortgage calculator plus#

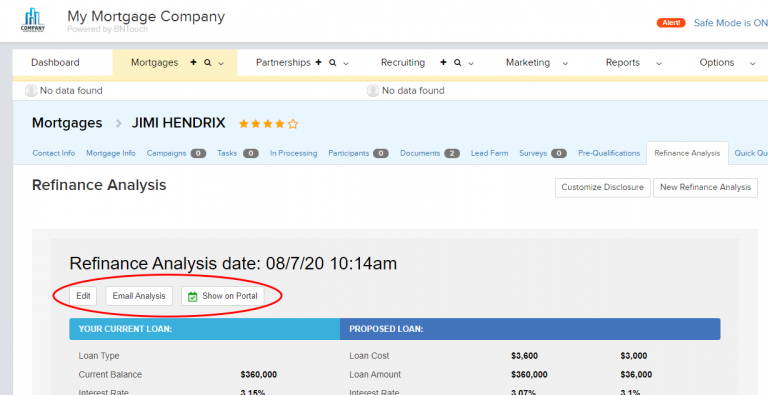

For mortgage loans, excluding home equity lines of credit, it includes the interest rate plus other charges or fees. APR is the cost to borrow money expressed as a yearly percentage. Lock your refinance rate: Work with your lender to lock your interest rate when you believe it's the lowest.Ĭomplete a home appraisal: Most lenders require a home appraisal.Ĭlose your loan: Review the closing documents and disclosures, pay any applicable closing costs, and sign.APR = Annual Percentage Rate. The Canadian Real Estate Association does not guarantee that all calculations are. Contact the lender, or find a lender to work with in your area.Īpply for a refinance: Once you apply, your lender will provide you with initial disclosures that outline the terms of the loan. This calculator is for demonstration purposes only. Shop refinance rates: Compare different interest rates using the custom rates tool or refinance calculator above to determine if refinancing at a current rate would accomplish your refinancing goals. Select a type of mortgage refinance: You have many refinancing options, including refreshing your rate and term (rate-and-term refinance), applying more cash toward your equity (cash-in refinance), pulling money out of your home equity (cash-out refinance), or opting for a streamline refinance to lower your monthly payments. The process of refinancing will follow these typical steps:

0 kommentar(er)

0 kommentar(er)